Fake money transfer is an illigal act to law of any country. So you looking for how to do fake transfer on PalmPay is not a good idea. However, do note that this article was written for educational purposes only. We don’t support any form of fruadlent activities.

In this article, we are going to be showing you how scammers will send you PalmPay fake transfer receipt to disguise as if they’ve just transferred you real money, and how not to fall victim or how to detect the fake money transfer.

POS agents and retail store sellers are people that usually fall victim of PalmPay fake money transfer. However, do know that PalmPay is a legit and legal mobile money service provider in Nigeria. The fintech is licenced by Central Bank of Nigeria (CBN) and insured by Nigeria Deposit Insurance Corporation (NDIC). So you been scammed via PalmPay Fake Transfer doesn’t mean the app is fake too.

How to do Fake Transfer on PalmPay

Like I said earlier that scammers prey on POS agents or retail store sellers. Here’s how they do it.

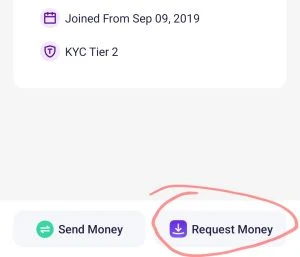

A man or woman will just walk to POS agent or provision store that has PalmPay POS terminal and requested to make transfer to the agent PalmPay Wallet. Once the agent agrees, the scammer will use something called “Request Money” that’s available in PalmPay App.

Request Money is a feature that allows PalmPay users to demand money from another PalmPay user. Scammers have been using this feature for fraudulent activities. Here’s how.

The scammer will just login to his PalmPay app, tap on the Request Money and enter recipient/agent PalmPay tag. He will request money e.g N10,000 and send the request. This will automatically generate a request transaction receipt. This receipt usually looks exactly like real money transfer receipt.

On the other side, the agent will also receive request money alert which will look like someone has just transferred you amount of N10,000. If the transaction receipt is not carefully checked out, you’ll fall victim of the scam.

How to detect PalmPay Fake Transfer

To detect fake money transfer from PalmPay app is easy. First and foremost, you should be suspicious if any stranger wake up to you and request your PalmPay tag and not transfer directly into your bank account.

Well, if you must accept to receive funds through PalmPay tag, you must make sure you check your transaction receipt and history to ensure the alert you received is not a request money alert.

A request money alert will usually has a “SUCCESSFUL” message, “SOMEONE HAS JUST REQUESTED MONEY FROM YOU” and “AMOUNT” of the money requested. This Notification will appear like you usually get real money alert. So beware of PalmPay Fraud and check your transaction carefully to confirm real payment before giving out funds.

RELATED ARTICLES:

What to do if you’ve already fall victim of PalmPay Fake Transfer?

If someone just scammed you using PalmPay Request Money features, just get the transaction receipt from history and tap on “Report” under the receipt. You’ll be redirected to page where you can log complain about the transaction.

Explain how you’ve just been scammed in full detail. Make sure you include the scammer PalmPay tag. You can also contact PalmPay customer care support team via email, include the transaction receipt, your PalmPay tag or account number, the scammer tag and explain the fraudulent activities in full details.

PalmPay customer specialist will see to your situation in less that 24 working hours. They might be able to flag the scammer account and reverse your money whenever a new fund enter the account.

However, you have to have strong evidence for PalmPay to help you with this kind of situation. So, it’s better to prevent fake money transfer from happening than seeking for way out after being scammed.

Conclusion

PalmPay Fake Transfer is a fraudulent activities that’s carryout using the Request Money features on the fintech app. This fraudulent activity is usually targeted towards point-of-sale (POS) agents and retail store sellers. However, to avoid this hacktivisties, you have to confirm your payment receipt carefully before you give up your money.

Thanks for reading this article, please share to your social media pages and join our Newsletter to get our finance scoops and updates directly in your inbox immidiately we publish them. Cheer!

Leave a Comment